Latest SMMT stats show that coach and bus registrations are up, but minibuses continue to lead the field

Latest SMMT stats show that coach and bus registrations are up, but minibuses continue to lead the field

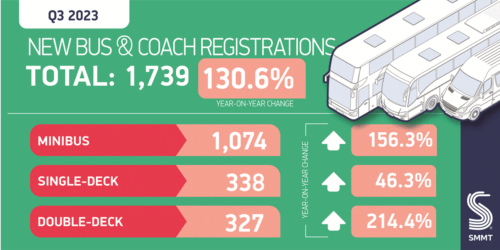

Latest figures from the Society of Motor Manufacturers & Traders (SMMT) show that demand for new buses, coaches and minibuses in the UK has more than doubled in the third quarter of 2023, up 130.6%, with 1,739 vehicles joining Britain’s fleets. The increase marks a second successive quarter of growth, with rising uptake of double- and single-deckers, up 214.4% and 46.3% respectively, but demand continues to be driven by minibus registrations, which are up 156.3%.

The figures show that operator demand more than doubled compared with the same quarter last year, as passenger levels return to pre-pandemic levels for the first time, providing a confidence boost for UK road transport services looking to replace their older vehicles. The period from July to September saw the greatest demand of any quarter since Q4 2019. The SMMT says that growth was driven primarily by deliveries of minibuses, up 156.3% to 1,074 units – representing 61.8% of the market – following a dip in demand in Q2 this year due to supply disruptions. Single-decker numbers rose by 46.3% to 338 units, and the number of double-deckers increased by 214.4% to 327. Overall, some 3,836 new buses and coaches have been registered in 2023 so far, the greatest demand from January to September in the last four years.

The return to 2019 ridership levels is positive, says the SMMT, but new vehicle demand this year still remains at 43.1% below the 2016 peak. With the sector currently on an upward trajectory, amid huge investment in the net zero transition to deliver 14 electric or hydrogen models to market, the SMMT believes it is well placed to deliver the benefits of mass green mobility, including an improved passenger and driver experience, better local air quality, more regular services and reduced noise pollution, but warns that these depend on increased vehicle uptake and the installation of depot charging infrastructure, which often require significant investment and improved grid connectivity.

The Society points out that as just 17 out of 48 regions in England made successful bids in the first round of Zero Emission Regional Bus Area (ZEBRA) funding, the launch of the second round in September is another chance to drive green fleet renewal, which could drive further sales. However, it called for a ‘simpler and smoother’ application process to ensure that some regions of Britain that are ready to decarbonise will not again miss the chance to drive the UK’s targets via the latest, greenest buses. At the same time, the allocation of round one funding to successful bidders must be

more timely, it said, so regions that have planned for decarbonisation can more quickly deliver affordable, widely accessible zero-emission mobility.

SMMT Chief Executive Mike Hawes commented: “Britain’s bus and coach sector has done the double, with new vehicle demand twice that of last year, resulting in two successive quarters of growth. As the sector exceeds pre-pandemic levels, it is now in a strong position to deliver green growth and tangible benefits for local communities. Operators want to invest in zero-emission fleets but action is needed, in particular to ensure that ZEBRA funding reaches all regions in a fair and timely manner – speeding up decarbonisation and improving services up and down the country.”