As Transport Ticketing Global celebrates its tenth year, James Day reports on the latest developments in payment technology on show.

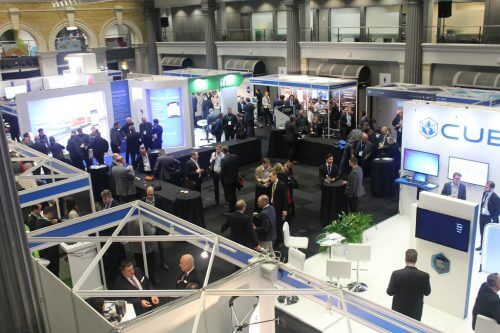

Returning to Old Billingsgate in London for the second year in a row, Transport Ticketing Global once again drew a large delegation from all over the world, with attendees from as far afield as North America and New Zealand.

This year, account-based ticketing dominated discussions, with many talks and presentations on how cities around the world are attempting to implement a highly integrated transport network powered by smart, digitised ticketing. Contactless, or EMV, saw a lot of praise, though many speakers were quick to state that it is not at the stage of making other forms of ticketing obselete, such as smartcards.

Host Card Emulation (HCE), where a smartphone operates as a smartcard, was also brought up several times, though the technology appears to be being held back by Apple handsets, which seem to be behind Android in this respect.

What follows are some of the highlights from the first day of the two day event, which CBW attended.[…]

By subscribing you will benefit from:

- Operator & Supplier Profiles

- Face-to-Face Interviews

- Lastest News

- Test Drives and Reviews

- Legal Updates

- Route Focus

- Industry Insider Opinions

- Passenger Perspective

- Vehicle Launches

- and much more!